Business Transformation Case Study

Situation

- UK’s leading Car Finance Organization that offers Loan to Bad Credit Customers

- The current website directs customers to fast-track applications but runs slow on gaining customer base as most of the leads are captured via other sources due to heavier images, old tech-stack & unavailability or low visibility of web pages via search

- Lead drop-out due to more time spent on completing the journey and most of it being manually driven by Organization representatives

Solution

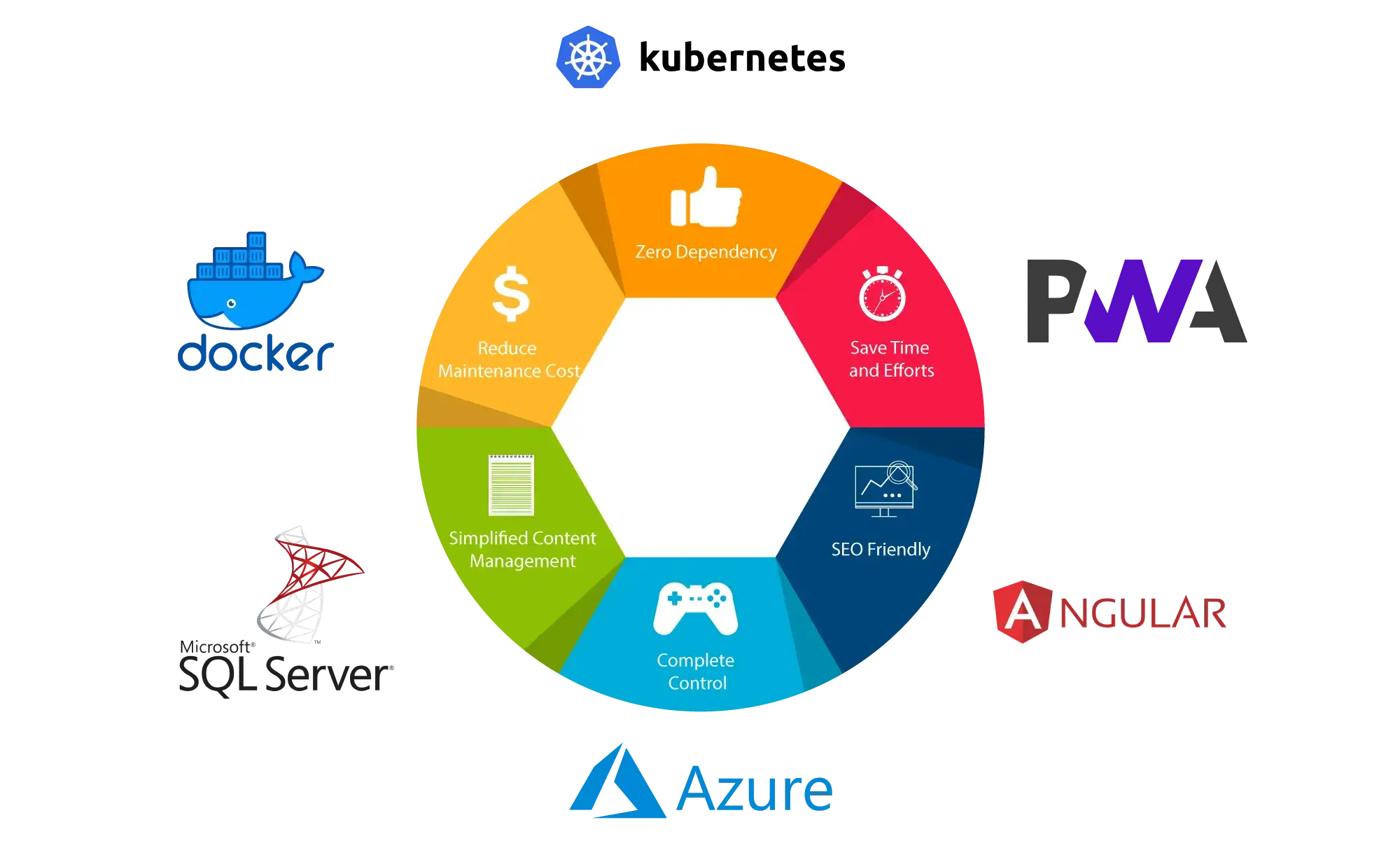

- Redesign front-end, middleware and back-end systems based on futuristic technology platform (Progressive Web Apps, Angular 10 & latest HTML version) with micro-frontend design.

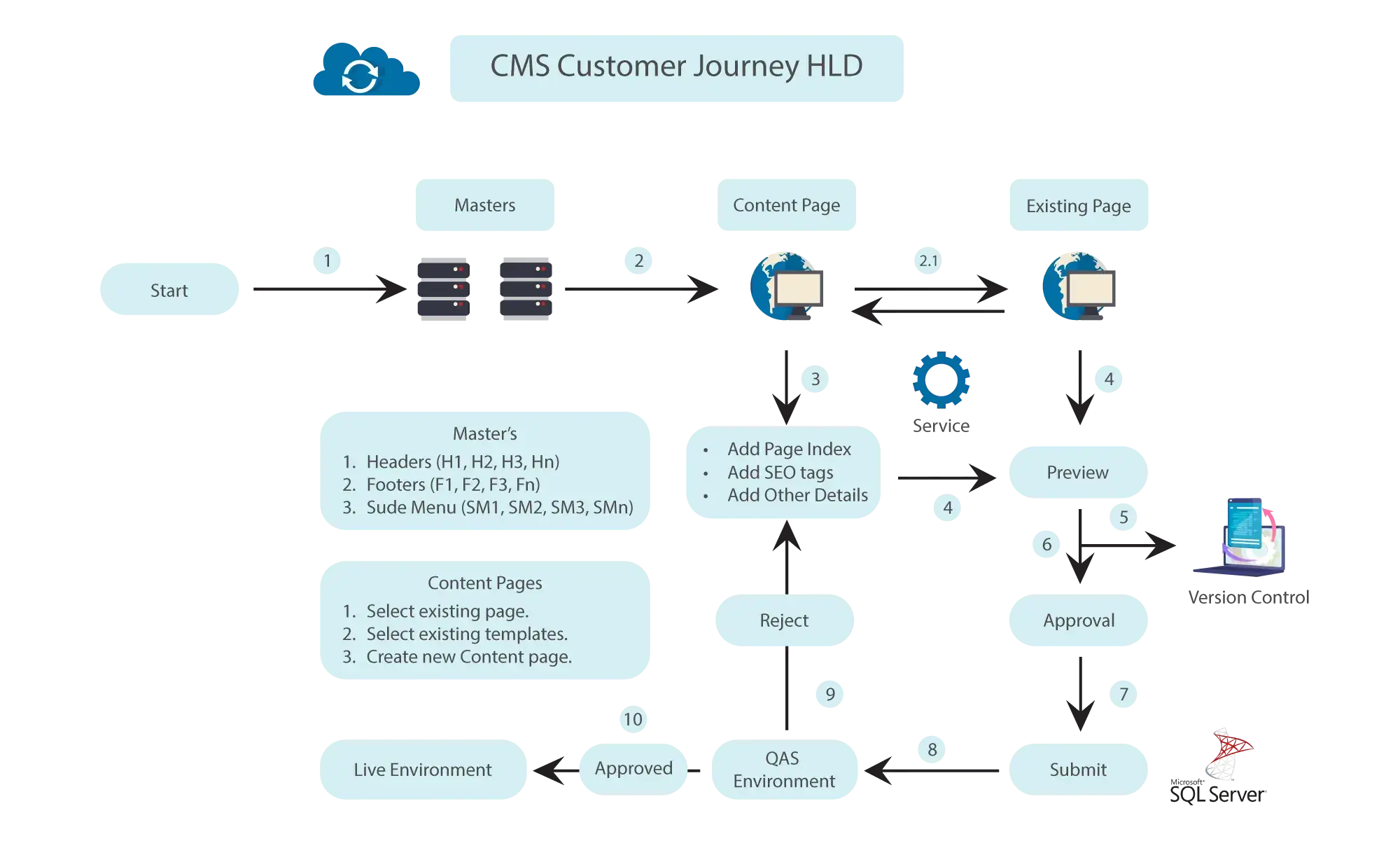

- Generic Content Building System that would undergo approval & version control before every publish/production move

- Generic Customer Journey Matrix configurable at any given time as per heat-maps, lead reports etc. wherein the access to matrix & Content is dependent on Profile Configs (again generic)

Benefits

- Enabling business to customize content based on the stages at which Leads drop-out or spend more time on by managing the same at any time without need of hard-code or monolithic approach

- Customizable customer journey matrix making it feasible to re-route the Customer Journey at any point of time to increase Customer base

- Ease of integration between the Content Management System (that sits in Axle) & the website along with other third parties that help in capturing the lead data while minimizing manual efforts & errors

Diagram 1.1 - Detailing Information

Diagram 1.2 - Detailing Information

Service Now Case Study

ServiceNow ITSM & CMDB for better visibility and management of IT and ServiceDesk

Hi-Tech Case Study

A pioneer in the technology industry with over 40 years of experience, is a premier global supplier of touch solutions including touchscreen

components, touch monitors, and all-in-one

Product Case Study

The UK base Fintech company, supplies quality used vehicles and finance to customers who have been declined elsewhere, even with poor/bad credit histories. They lend money and make their own decisions.